The 'due-date' for filing income-tax returns for Assessment-Year 2019-20 extended to 31st August 2019

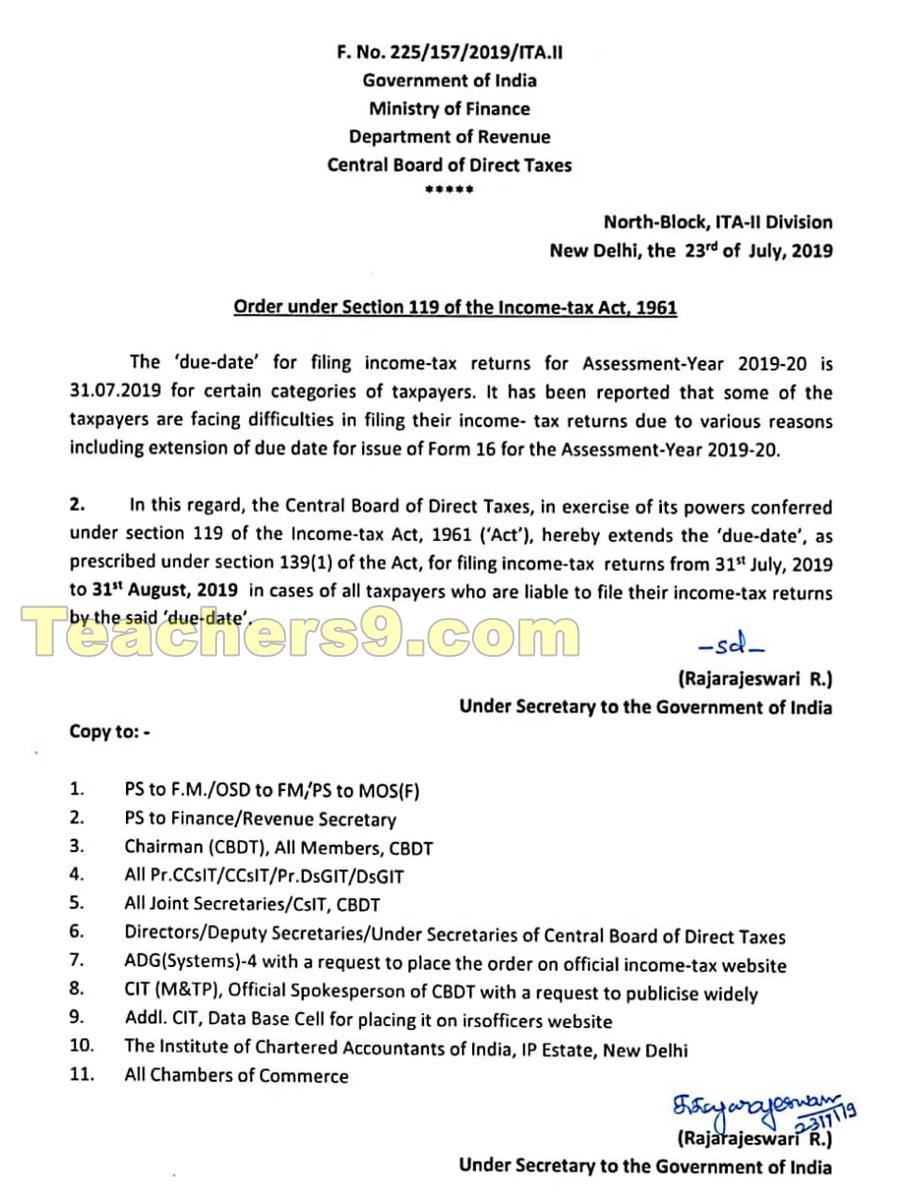

The 'due-date' for filing income-tax returns for Assessment-Year 2019-20 is 31.07.2019 for certain categories Of taxpayers. It has been reported that some of the taxpayers are facing difficulties in filing their income- tax returns due to various reasons including the extension of due date for issue of Form 16 for the Assessment-Year 2019-20.

In this regard, the Central Board Of Direct Taxes, in exercise of its powers conferred under section 119 Of the Income-tax Act, 1961 ('Act'), hereby extends the 'due-date', as prescribed under section 139(1) of the Act, for filing income-tax returns from 31st July, 2019 to 31st August 2019 in cases of all taxpayers who are liable to file their income tax returns by the said due date.

The 'due date' for filing income-tax returns for Assessment-Year 2019-20 extended to 31st August 2019.

The 'due-date' for filing income-tax returns for Assessment-Year 2019-20 is 31.07.2019 for certain categories Of taxpayers. It has been reported that some of the taxpayers are facing difficulties in filing their income- tax returns due to various reasons including the extension of due date for issue of Form 16 for the Assessment-Year 2019-20.

In this regard, the Central Board Of Direct Taxes, in exercise of its powers conferred under section 119 Of the Income-tax Act, 1961 ('Act'), hereby extends the 'due-date', as prescribed under section 139(1) of the Act, for filing income-tax returns from 31st July, 2019 to 31st August 2019 in cases of all taxpayers who are liable to file their income tax returns by the said due date.

The 'due date' for filing income-tax returns for Assessment-Year 2019-20 extended to 31st August 2019.